Navigating Car Insurance Requirements for Expats in Spain

Understanding Car Insurance for Expats in Spain

Moving to a new country is always an exciting adventure, but it comes with its own set of challenges, especially when it comes to understanding local regulations. For expats in Spain, navigating the world of car insurance can be daunting. However, having the right information can make this process much smoother, ensuring you are adequately covered while on the road.

Why Car Insurance is Essential in Spain

Like many countries, Spain mandates that all drivers have car insurance. This requirement is in place to protect all road users and ensure that, in the event of an accident, there is a financial safety net for damages and injuries. For expats, understanding these requirements is crucial to avoid legal issues and ensure peace of mind.

Types of Car Insurance Available

There are several types of car insurance policies available in Spain, and choosing the right one depends on your needs and circumstances. The basic level of coverage required by law is third-party liability insurance. This covers damage or injury to third parties but does not cover your own vehicle.

Additional Coverage Options

In addition to third-party liability insurance, expats can opt for additional coverage to enhance their protection. These include:

- Comprehensive Insurance: Covers both third-party liabilities and damages to your own vehicle.

- Collision Coverage: Specifically covers damages resulting from a collision.

- Theft and Fire Coverage: Protects against theft or damage due to fire.

Steps to Obtain Car Insurance in Spain

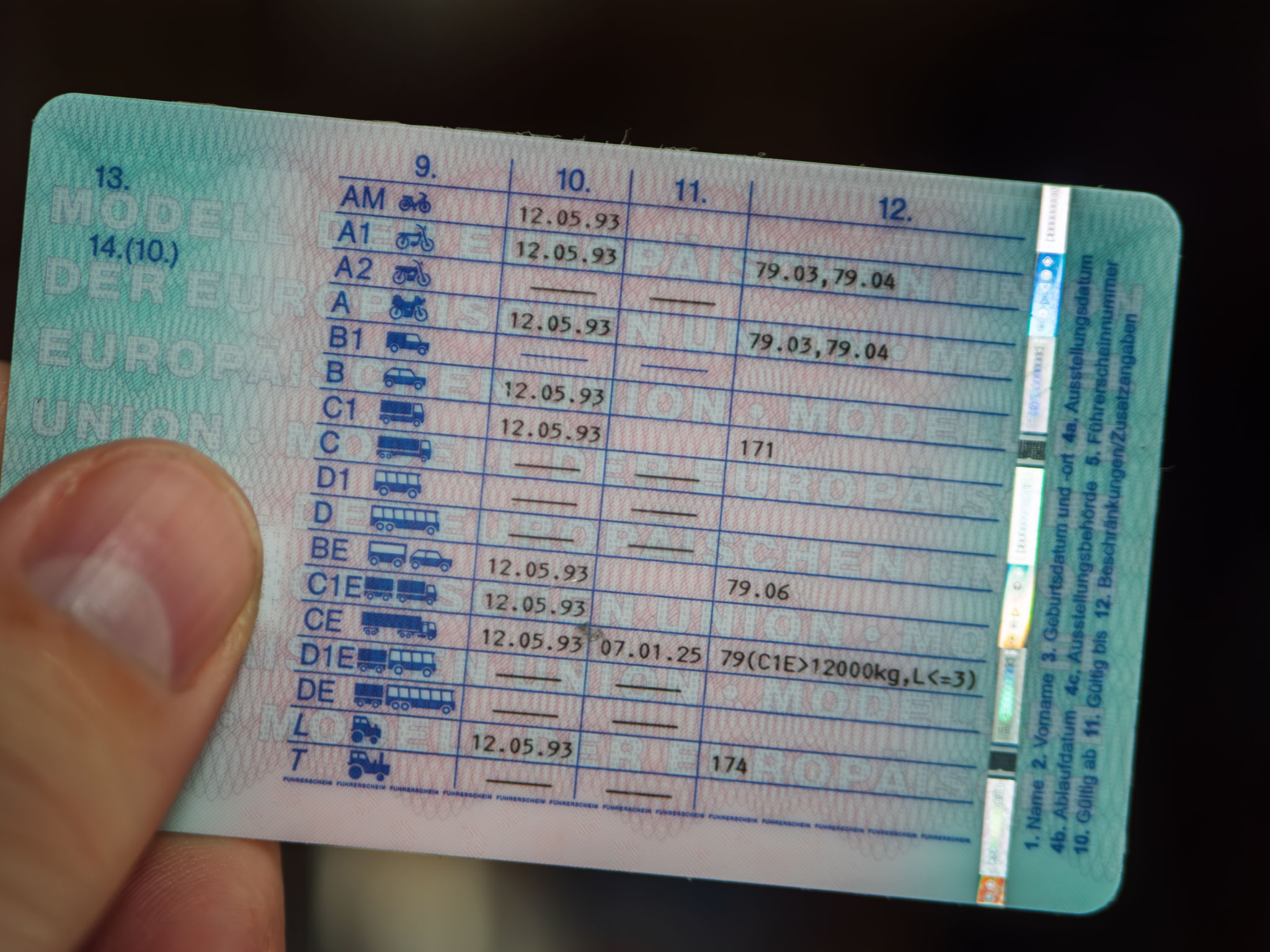

Securing car insurance in Spain involves a few straightforward steps. First, you need to gather necessary documents such as your driving license, vehicle registration, and evidence of no claims bonus from your previous insurer if applicable. With these in hand, you can approach various insurers to get quotes.

Choosing the Right Insurer

When selecting an insurer, consider factors beyond just the premium cost. Look at the insurer’s reputation, customer service quality, and the specific terms and conditions of the policy. Comparing multiple quotes can help you find a policy that offers the best balance between cost and coverage.

Understanding the Claims Process

If you need to file a claim, it’s essential to understand the process involved. Typically, this involves notifying your insurer as soon as possible after an incident. Provide them with all necessary details such as photographs of the damage and any witness statements. Being prompt and thorough can facilitate a smoother claims process.

Common Pitfalls to Avoid

Many expats fall into common pitfalls when dealing with car insurance in Spain. These include underestimating the importance of reading the fine print and not declaring all relevant information when applying for insurance. Honesty and thoroughness are key to ensuring your coverage is valid when you need it most.

Navigating car insurance as an expat in Spain doesn’t have to be overwhelming. By understanding the types of coverage available, choosing the right insurer, and being informed about the claims process, you can confidently manage your car insurance needs while enjoying your new life in Spain.