Choosing Car Insurance for Expats in Spain: Essential Tips

Understanding the Basics of Car Insurance in Spain

Relocating to a new country comes with various challenges, and one of the critical aspects expats need to consider is securing adequate car insurance. In Spain, car insurance is not just a legal requirement but also a smart move to protect yourself financially. Understanding the basics of Spanish car insurance can help you make informed decisions.

Types of Car Insurance Policies Available

In Spain, there are several types of car insurance policies to choose from, each offering varying levels of coverage. The main types include:

- Third-Party Liability Insurance (Seguro a Terceros): This is the most basic and mandatory insurance, covering damages to other vehicles and property.

- Third-Party, Fire and Theft (Seguro a Terceros Ampliado): In addition to third-party liability, it covers damages from fire and theft.

- Comprehensive Insurance (Seguro a Todo Riesgo): Offers extensive coverage, including your vehicle's damages, regardless of fault.

Key Factors to Consider When Choosing a Policy

Selecting the right car insurance policy involves assessing several factors to ensure it aligns with your needs. Consider the following:

- Coverage Level: Decide whether you need basic third-party coverage or a comprehensive policy.

- Deductibles: Higher deductibles can lower your premium but mean paying more out-of-pocket in case of a claim.

- Cost: Compare premiums from different providers while ensuring the coverage suits your requirements.

Finding the Right Insurance Provider

The Spanish car insurance market is competitive, with numerous providers offering various options. It's crucial to research and compare different insurers to find one that offers reliable service and good value. Look for companies with strong customer reviews and robust support services for expats.

Understanding Insurance Terms and Conditions

Insurance policies often come with complex terms and conditions. Make sure you thoroughly understand these details before signing up. Pay attention to:

- The scope of coverage and any exclusions.

- The process for filing claims and the time frame for settlements.

- Any additional benefits or add-ons that could enhance your policy.

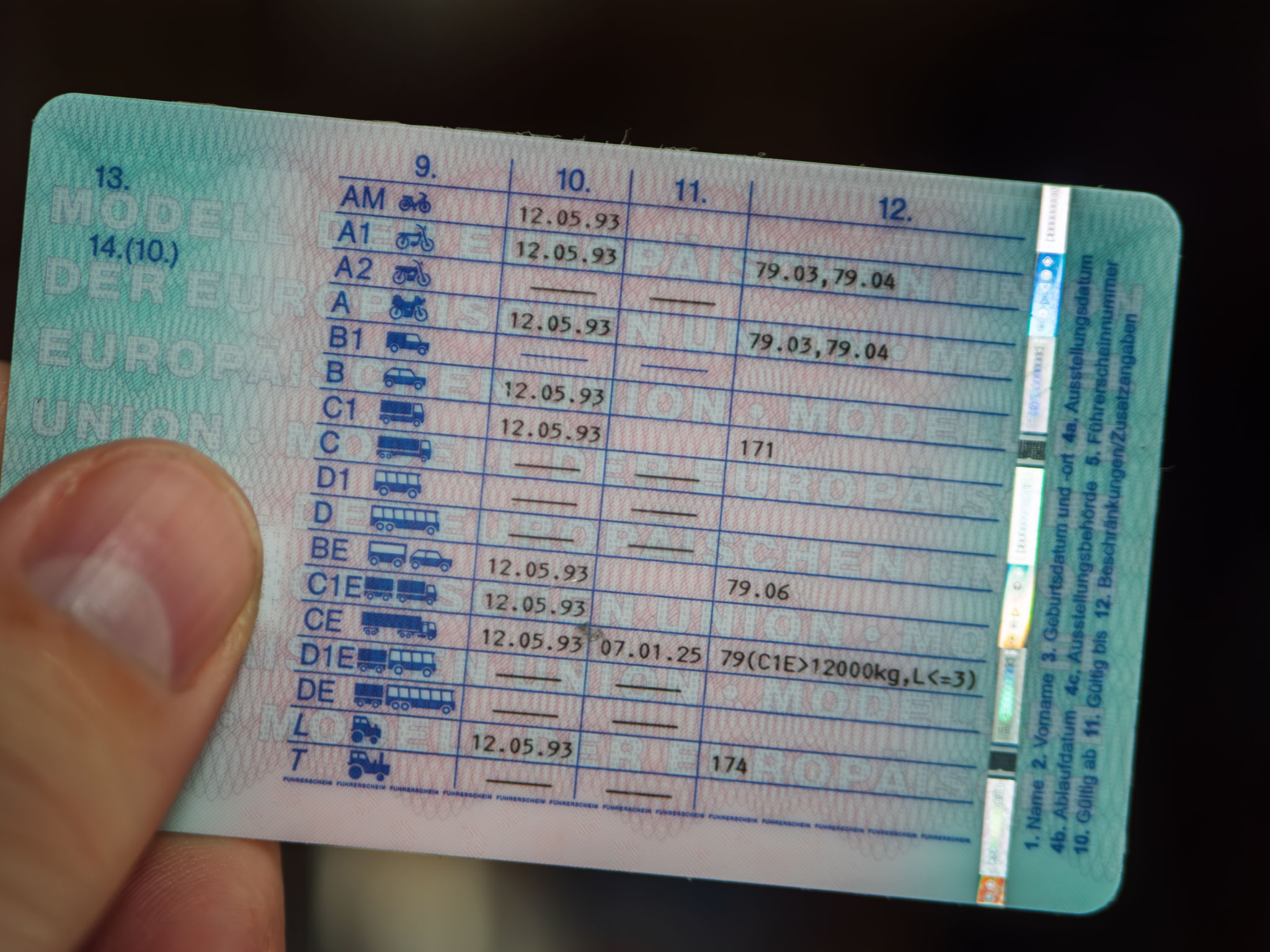

Navigating Legal Requirements and Documentation

As an expat, navigating the legal requirements for car insurance in Spain can be daunting. Ensure you have all necessary documentation ready, such as your driver's license, vehicle registration, and proof of address. Being well-prepared can streamline the process and prevent potential legal issues.

Benefiting from Local Expertise

Consider consulting with local insurance experts or brokers who understand the intricacies of the Spanish market. They can provide personalized advice based on your specific circumstances, helping you choose a policy that offers optimal protection while meeting legal obligations.

Taking Advantage of Discounts and Offers

Many insurers offer discounts or special offers for expats. These may include no-claims bonuses, multi-policy discounts, or reduced rates for safe drivers. Always inquire about available discounts when negotiating your policy to maximize savings.

Choosing the right car insurance as an expat in Spain doesn't have to be overwhelming. By understanding your options and considering your personal needs, you can secure a policy that provides peace of mind on the road.